RPC, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

2801 Buford Highway NE, Suite 300, Atlanta, Georgia 30329

TO THE HOLDERS OF THE COMMON STOCK:

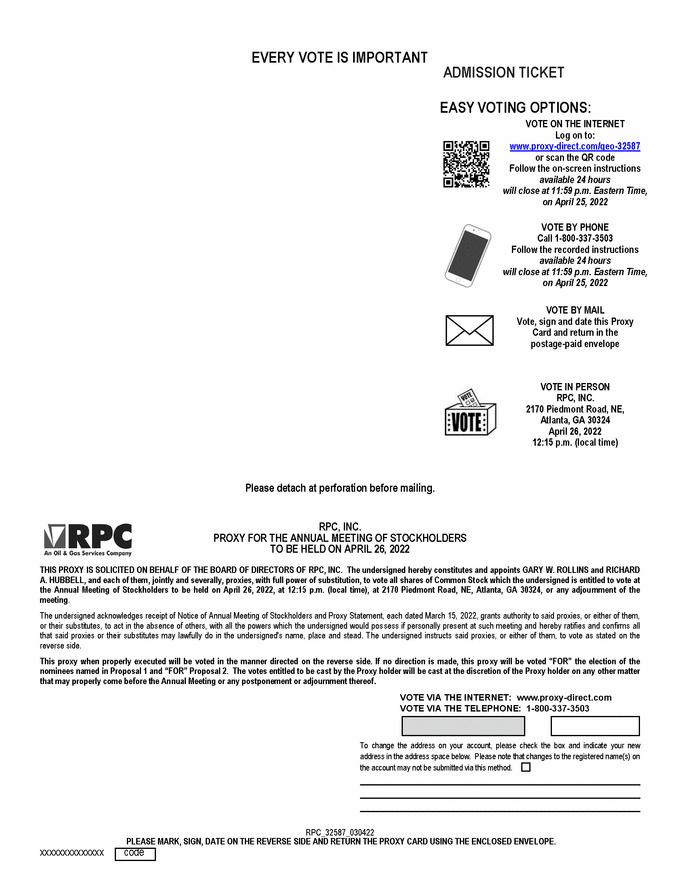

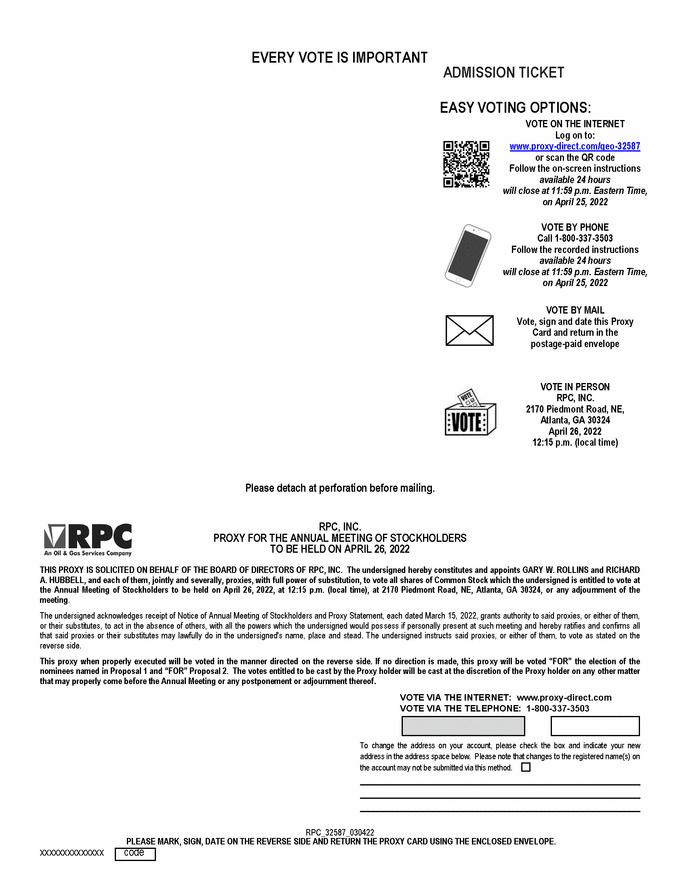

PLEASE TAKE NOTICE that the 2022 Annual Meeting of Stockholders of RPC, Inc., a Delaware corporation (“RPC” or the “Company”), will be held at 2170 Piedmont Road, NE, Atlanta, Georgia, on Tuesday, April 26, 2022, at 12:15 P.M., for the following purposes, as more fully described in the Proxy Statement accompanying this notice:

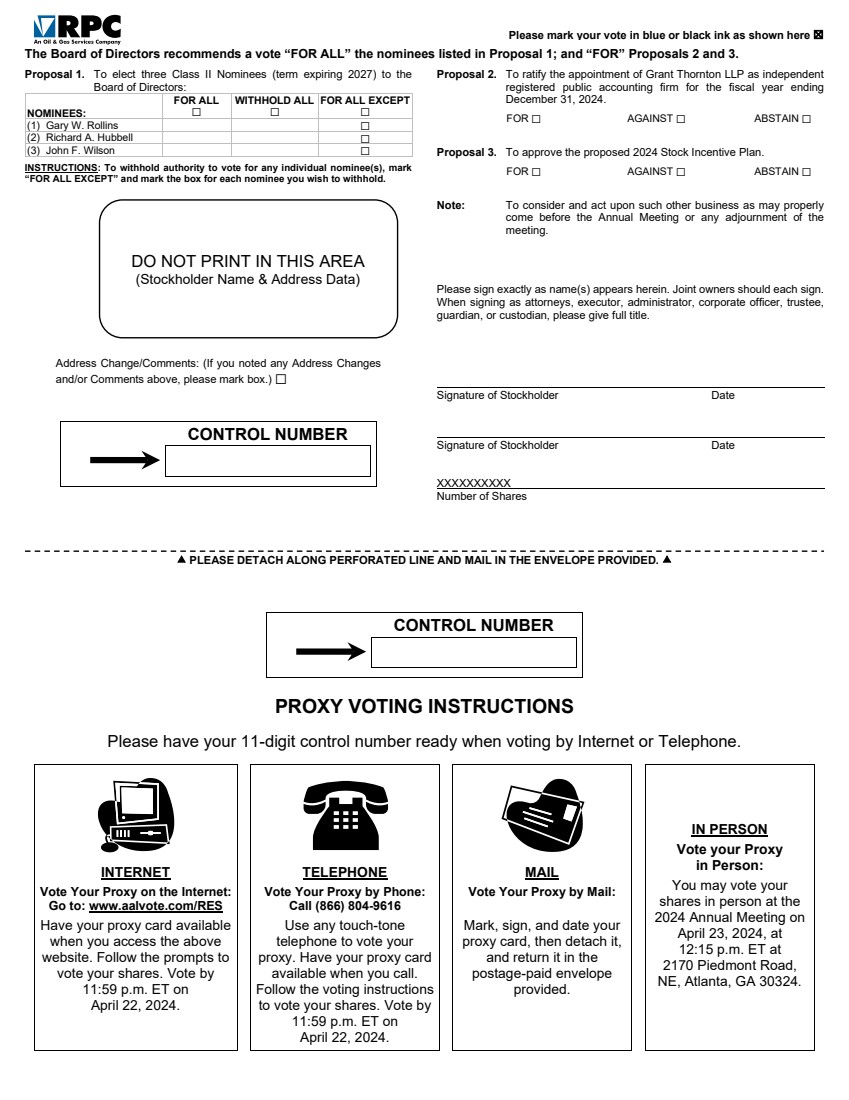

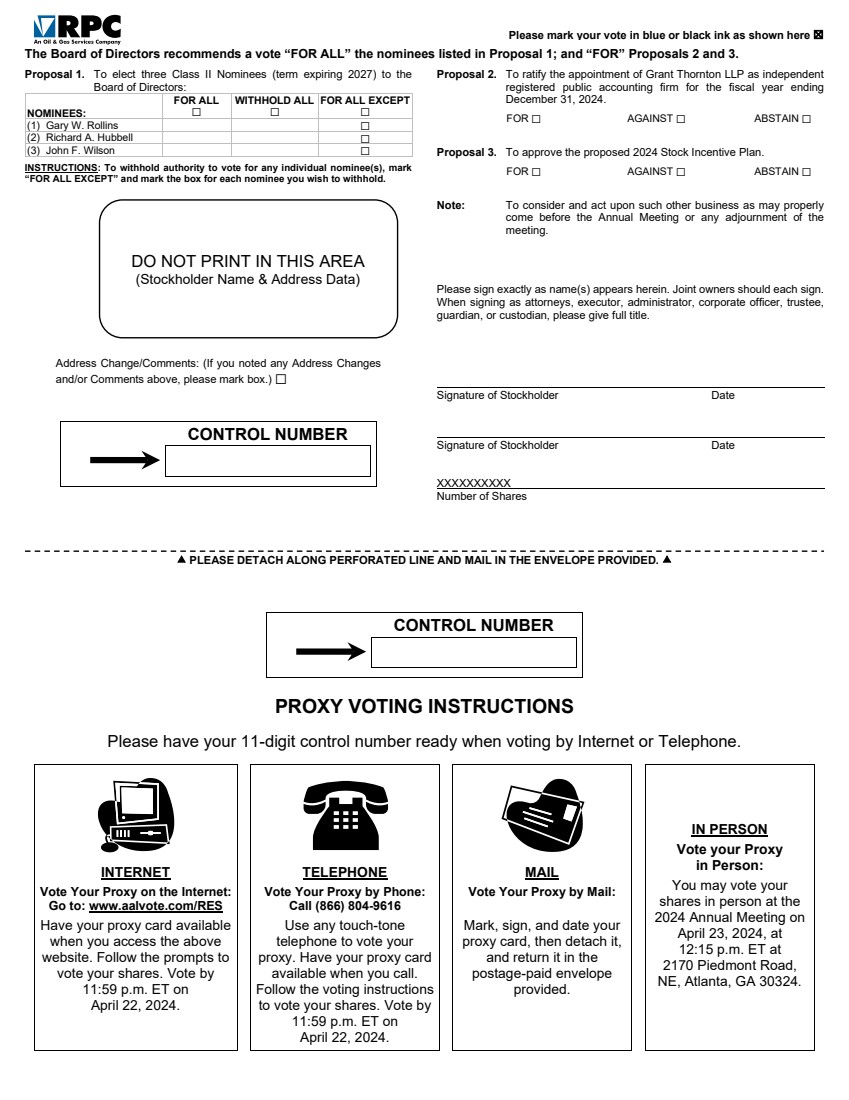

| 2801 Buford Highway NE, Suite 300, Atlanta, Georgia 30329 TO THE HOLDERS OF THE COMMON STOCK: PLEASE TAKE NOTICE that the 2024 Annual Meeting of Stockholders of RPC, Inc., a Delaware corporation (“RPC” or the “Company”), will be held at 2170 Piedmont Road, NE, Atlanta, Georgia, on Tuesday, April 23, 2024, at 12:15 P.M., for the following purposes, as more fully described in the Proxy Statement accompanying this notice: 1. | To elect the three Class IIIII nominees identified in the attached Proxy Statement to the Board of Directors; |

| 2. | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;2024; 3. To approve the 2024 Stock Incentive Plan; and |

| 3.

| 4. To consider and act upon such other business as may properly come before the Annual Meeting or any adjournment of the meeting. |

The Proxy Statement dated March 15, 2022 is attached.

The Board of Directors has fixed the close of business on March 1, 2022 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

As permitted by the U.S. Securities and Exchange Commission rules, the Company is making the proxy materials relating to the Annual Meeting, including this Proxy Statement and the Company’s 2021 Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “Annual Report”), available to our stockholders electronically via the Internet. On or about March 15, 2022, we mailed to our stockholders an Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 26, 2022 (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and vote online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. The Notice instructs you on how to access and review all important information contained in the Proxy Statement and Annual Report. The Notice also instructs you on how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice.

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on April 26, 2022: The 2022 Proxy Statement and 2021 Annual Report on Form 10-K to security holders are available at https://www.proxy-direct.com/geo-32587.

| RPC, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS Voting can be completed in one of four ways:

| | | | | | | ·The Proxy Statement dated March 14, 2024, is attached.

The Board of Directors has fixed the close of business on March 1, 2024 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. As permitted by the U.S. Securities and Exchange Commission rules, the Company is making the proxy materials relating to the Annual Meeting, including this Proxy Statement and the Company’s 2023 Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”), available to our stockholders electronically via the Internet. On or about March 14, 2024, we mailed to our stockholders an Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 23, 2024 (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and vote online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. The Notice instructs you on how to access and review all important information contained in the Proxy Statement and Annual Report. The Notice also instructs you on how you may submit your proxy over the Internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Notice. Important Notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on April 23, 2024: The 2024 Proxy Statement and 2023 Annual Report on Form 10-K to security holders are available at https://www.viewproxy.com/RPC/2024. Voting can be completed in one of four ways: | | |

|

|

|

| | | Returning the Proxy Card by Mail |

| ·

| Via Telephone at 1-800-337-3503 | ·1-866-804-9616

| Online at https://www.proxy-direct.com/geo-32587www.AALvote.com/ RES |

| ·

| Attending the meeting to vote In Person |

| | | BY ORDER OF THE BOARD OF DIRECTORSBy Order Of The Board Of Directors

| |

| | Ben M. Palmer

| | | | Michael L. Schmit | | Corporate Secretary | Atlanta, Georgia | | March 14, 2024 | |

Atlanta, Georgia

March 15, 2022

Whether or not you expect to attend the annual meeting, please sign, date and return the enclosed proxy card promptly. Alternatively, you may vote your proxy by telephone or over the Internet by following the instructions on your proxy card or Notice. If you decide to attend the meeting, you may, if you wish, revoke the proxy and vote your shares in person.

MESSAGE FROM OUR CHIEF EXECUTIVE OFFICER To our Stockholders, On behalf of the Board of Directors, we are pleased to announce that we will hold our 2024 Annual Meeting of Stockholders on Tuesday, April 23rd, 2024 at 12:15 P.M. 2023 was a year of several positive developments and milestones for RPC, marked by strong financial performance as we navigated a dynamic industry environment. While revenues increased 1% to $1.62 billion, and diluted earnings per share was $0.90, versus $1.01 in 2022, we generated approximately $395 million of cash from operating activities, nearly doubling the prior year amount. With a year-end cash position of $223 million and no debt, we are confident in our ability to invest in the business and continue returning capital to shareholders. In 2023 we paid nearly $35 million in dividends and bought back nearly $19 million of stock under our buyback program, building on our strong capital return track record. We upgraded our asset base with new equipment this past year, as well as acquired the Spinnaker cementing business. Spinnaker is a high-quality industry leader, and this acquisition expanded our service lines and broadened our customer base. The acquisition has gone well, and we are proud of the organization’s success acquiring and integrating this outstanding business into the RPC family. We enter 2024 with a healthy balance sheet, an appetite to continue prudently expanding the business, and optimism for another year of solid financial performance. We also have another important milestone we are proud to share – the publication of our first corporate sustainability report. Beyond increasing regulatory, operational, and disclosure requirements around ESG (Environmental, Social and Governance), we understand that communication about our ESG-related initiatives is important to customers, suppliers, employees, and investors. We look forward to making continued progress on all sustainability fronts and sharing updates through these reports on an annual basis. As we begin 2024, we want to recognize our employees across the company for another year of dedication and resilience. We are especially proud that Thru Tubing Solutions, our downhole tools company, has been recognized as a 2023 Top Workplace by both USA TODAY and The Oklahoman. This prestigious accolade is a testament to our commitment to fostering a vibrant and inclusive work environment. We would also like to thank our loyal customers who continue to choose RPC for our reliability, value proposition and overall outstanding service. I want to express to all our stakeholders that we remain committed to the financial discipline and conservative approach that has been our hallmark for decades and the backbone of our longevity and success. Sincerely,

Ben M. Palmer

President and Chief Executive Officer SUSTAINABILITY AT RPC We are an oil and gas services company that provides a broad range of specialized oilfield services and equipment. RPC serves independent as well as major oilfield companies and oil and gas properties throughout the United States and in select international markets. We are highly regarded for our business ethics, fiscal management and our consistent focus on safety and the wellness of our employees. We consistently deliver high quality services to our customers, provide safe and rewarding work for our employees, and returns to shareholders throughout the many cycles and challenges of our sector. During 2023, RPC made meaningful progress formalizing, documenting and enhancing policies and procedures to better communicate our corporate sustainability commitments to our stakeholders. This included surveying our stakeholders on the materiality of topics related to: The results are in our 2023 Corporate Sustainability report and provided valuable insight to our Board, Executive Leadership and Steering Committee on material topics. In addition, we found external stakeholders preferred key policies separated into formal documents preferred to incorporating these policies into a Code of Conduct like RPC had previously done. The Steering Committee worked to separate and enhance these policies before sending them to the Board for review. These new policies are available on our website as listed below: | ● | Human capital management; |

| ● | Workplace health and safety; and |

For 2024, RPC will review responses from external stakeholders on our first report publication and incorporate changes where needed. RPC will also focus on reducing data estimation and improving the collection process. Providing relevant guidance and oversight are our three Board committees that support RPC’s ESG efforts in their respective areas: | ● | The Nominating and Corporate Governance Committee is responsible for monitoring our general ESG practices, policies, programs, and public disclosures. |

| ● | The Human Capital Management and Compensation Committee provides oversight of the development and management of RPC's human capital management strategies and policies – including diversity, equity, and inclusion. |

| ● | The Audit Committee is responsible for oversight of RPC’s cybersecurity risk management program and provides management with guidance on our sustainability and ESG reporting disclosures and related internal control procedures. |

These matters are reviewed on a periodic basis by each respective Board committee. Additionally, a steering committee, which includes members of executive management along with representatives of other key stakeholder groups, meets more frequently to discuss relevant topics. PROXY STATEMENT We are furnishing the proxy materials to stockholders on or about March 15, 2022.14, 2024. The Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 26, 2022,23, 2024. Proxy Statement and the Annual Report on Form 10-K are available at https://www.proxy-direct.com/geo-32587.www.viewproxy.com/RPC/2024. The following information concerning the proxy and the matters to be acted upon at the Annual Meeting of Stockholders to be held on April 26, 202223, 2024 is submitted by the Company to the stockholders in connection with the solicitation of proxies on behalf of the Company’s Board of Directors. SOLICITATION OF AND POWER TO REVOKE PROXY A form of proxy is enclosed. Each proxy submitted will be voted as directed, but if not otherwise specified, proxies solicited by the Board of Directors of the Company will be voted in favor of the candidates for election to the Board of Directors, and in favor of ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.2024, and in favor of the proposed 2024 Stock Incentive Plan. A stockholder executing and delivering a proxy has power to revoke the same and the authority thereby given at any time prior to the exercise of such authority, if they so elect, by contacting either proxy holder, by timely submitting a later dated proxy changing their vote, or by attending the meeting and voting in person. However, a beneficial stockholder who holds his shares in street name must secure a proxy from theirhis broker before theyhe can attend the meeting and vote. All costs of solicitation have been, and will be, borne by the Company. HOUSEHOLDING AND DELIVERY OF NOTICE OR PROXY MATERIALS The Company has adopted the process called “householding” for any notice or proxy materials in order to reduce printing costs and postage fees. Householding means that stockholders who share the same last name and address will receive only one copy of the notice or proxy materials, unless we receive contrary instructions from any stockholder at that address. If you prefer to receive multiple copies of the proxy materials at the same address, additional copies will be provided to you promptly upon written or oral request. If you are a stockholder of record, you may contact us by writing to the Company at 2801 Buford Highway NE, Suite 300, Atlanta, GA 30329 or by calling 404-321-2140. Eligible stockholders of record receiving multiple copies of the proxy materials can request householding by contacting the Company in the same manner. CAPITAL STOCK The outstanding capital stock of the Company on March 1, 20222024 consisted of 216,493,794215,445,403 shares of Common Stock, par value $0.10 per share. Holders of Common Stock are entitled to one vote (non-cumulative) for each share of such stock registered in their respective names at the close of business on March 1, 2022,2024, the record date for determining stockholders entitled to notice of, and to vote at, the meeting or any adjournment thereof.

A majority of the outstanding shares will constitute a quorum at the Annual Meeting. Meeting. Abstentions will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. With respect to routine matters, if your shares are held through a broker and you do not instruct the broker on how to vote your shares, your broker may choose to leave your shares unvoted or to vote your shares on the routine matters. Proposal 2, with respect to the ratification of the auditor, is the only routine matter on the agenda at this year’s Annual Meeting. With respect to Proposal 1 and 3, without instructions, your broker cannot vote your shares, resulting in what are known as “broker non-votes.” Broker non-votes will not be entitled to be counted for the purpose of determining the number of votes cast and present and eligible to be cast on Proposals 1 and 3. In accordance with the General Corporation Law of the state of Delaware, the following votes are needed for approval of each proposal: | | | |

|---|

| PROPOSAL | | VOTE NEEDED FOR APPROVAL AND EFFECT OF ABSTENTION AND BROKER NON-VOTES |

|---|

Proposal No. 1:The election of three Class IIIII director nominees to serve as directors of the Company until our 20252027 annual meeting of stockholders or until their successors are duly elected and qualified. | The election of the director nominees named herein will require the affirmative vote of a plurality of the votes cast by the shares of Company Common Stock entitled to vote in the election provided that a quorum is present at the Annual Meeting. In the case of a plurality vote requirement (as in the election of directors), where no particular percentage vote is required, the outcome is solely a matter of comparing the number of votes cast for each nominee, with those nominees receiving the most votes being elected, and hence only votes for director nominees (and not abstentions or broker non-votes) are relevant to the outcome. In this case, the three nominees receiving the most votes will be elected. | Proposal No. 2: To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. 2024.

| The affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote with respect to this proposalat the meeting is required to approve the ratification of the appointment of the Company’s independent registered public accounting firm for fiscal year 2022. 2024 provided that a quorum is present at the Annual Meeting. Abstentions will have the effect of a vote against this proposal. Broker non-votes will have no effect on this proposal and will be disregarded. |

| |

|---|

PROPOSAL | VOTE NEEDED FOR APPROVAL AND EFFECT OF ABSTENTION AND BROKER NON-VOTES |

|---|

Proposal No. 3: To approve the proposed 2024 Stock Incentive Plan. | The approval of the 2024 Stock Incentive Plan will require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the meeting with respect to this proposal provided that a quorum is present at the Annual Meeting. Abstentions will have the effect of a vote against this proposal. Broker non-votes will have no effect on this proposal and will be disregarded. |

There are no rights of appraisal or similar dissenter’s rights with respect to any matter to be acted upon pursuant to this Proxy Statement. It is expected that shares held of record and beneficially by officers and directors of the Company and their affiliates, which in the aggregate represent approximately 66 percent60% of the outstanding shares of Common Stock, will be voted for the nominees, and for the ratification of the appointment of the Company’s independent registered public accounting firm.firm, and for the approval of the 2024 Stock Incentive Plan. BOARD OF DIRECTORS AND CORPORATE GOVERNANCE Meetings and Committees of the Board of DirectorsMEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Company’s Board of Directors (Board) has an Audit Committee, Executive Committee, Human Capital Management and Compensation Committee, and a Nominating and Corporate Governance Committee, and an Executive Committee (Committees). The Board has adopted written charters for certain of these Committees which are all available on our website at www.rpc.netwww.rpc.net under the section titled Governance.

Under our Corporate Governance Guidelines, directors are expected to attend all regular and special meetings of the Board and Board committeesCommittees upon which they serve. Directors are also expected to attend the Annual Stockholders Meeting. Each incumbent director attended at least 75 percent75% of the aggregate of all Board meetings and meetings of the Board committeesCommittees on which they served during 2021,2023, and all members of the Board at the time attended last year’s Annual Stockholders Meeting. The following table shows the current membership (M) and chairperson (C) of the Board and each of the Board committees, the number of Board and Board committee meetings held in 20212023, and actions taken by unanimous written consent in lieu of meetings: | | | | | | | | | | | | | | | | | | | Human Capital | | Nominating & | | | | | | | | | Management and | | Corporate | | | Board of | | Audit | | Executive | | Compensation | | Governance | Name | | Directors | | Committee | | Committee | | Committee | | Committee | Richard A. Hubbell | | C | | | | C | | | | | Susan R. Bell | | M | | M | | | | | | | Patrick J. Gunning | | M | | C | | | | M | | M | Amy R. Kreisler | | M | | | | | | | | M | Jerry W. Nix (1) | | M | | M | | | | C | | C | Ben M. Palmer | | M | | | | M | | | | | Gary W. Rollins | | M | | | | | | | | | Pamela R. Rollins | | M | | | | | | | | | Timothy C. Rollins | | M | | | | | | | | M | John F. Wilson | | M | | M | | | | M | | M | Meetings Held | | 5 | | 6 | | — | | 4 | | 3 | Actions Taken by Written Consent | | — | | — | | 1 | | 1 | | — |

| | | | | | | | | | | | | | | | | | | Human Capital | | Nominating & | | | | | | | | | Management and | | Corporate | | | Board of | | Audit | | Executive | | Compensation | | Governance | Committee Member | | Directors | | Committee | | Committee | | Committee | | Committee | Gary W. Rollins | | C | | | | M | | | | | Richard A. Hubbell | | M | | | | M | | | | | Susan R. Bell | | M | | M | | | | | | | Patrick J. Gunning | | M | | C | | | | M | | M | Jerry W. Nix(1) | | M | | M | | | | C | | C | Pamela R. Rollins | | M | | | | | | | | | Amy Rollins Kreisler | | M | | | | | | | | | Meetings Held | | 5 | | 5 | | — | | 3 | | 2 | Actions Taken by Written Consent | | 1 | | — | | 7 | | — | | — |

| (1) | Lead Independent Director |

(1)Lead Director

Audit Committee

The Audit Committee of the Board of Directors currently consists of Messrs. Patrick J. Gunning (Chairperson), Jerry W. Nix, and Ms. Susan R. Bell. For the year ended December 31, 2021, Mr. Harry J. Cynkus served as the Chairperson of the Audit CommitteeBell and resigned at the end of 2021.John F. Wilson. The Audit Committee is responsible for, among other things:

| > | ● | appointing the Company’s independent registered public accounting firm to audit the Company’s financial statements; |

| > | ● | assessing the independence and overseeing the performance of the Company’s independent registered public accounting firm; |

| > | ● | pre-approving all audit and all permissible non-audit services to be performed by the Company’s independent registered public accounting firm; |

| > | discussing with the Company’s independent registered public accounting firm all matters required to be discussed under the standards of the Public Company Accounting Oversight Board, Securities and Exchange Commission (SEC) or other regulations; |

| > | ● | reviewing the Company’s financial statements and critical accounting policies and estimates; |

| > | ● | reviewing the adequacy and effectiveness of our internal controls and disclosure controls and procedures; |

| > | ● | assessing the performance of the Company’s internal audit department; |

| > | ● | reviewing the Company’s insider trading and anti-corruption policies; |

| > | ● | overseeing procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters; and |

| > | ● | overseeing compliance with the Company’s codeCode of business conductBusiness Conduct and ethics.Ethics. |

The Board has determined that all of the members of the Audit Committee are independent as defined by the rules of the SEC and the New York Stock Exchange (NYSE). The Board has also determined that all members of the Audit Committee with the exception of John F. Wilson are qualified as “Audit Committee Financial Experts” within the meaning of the rules of the SEC and that they have accounting andor related financial management expertise within the meaning of the NYSE listing standards. In addition, the Board has determined that Mr. Wilson is “financially literate” within the meaning of and as required by the rules and regulations of the NYSE. The Board has also determined that Ms. Bell’s simultaneous service on the audit committees of four public companies will not impair her ability to effectively serve on the Company’s Audit Committee.

Diversity Committee

In December 2021, the Board dissolved the Diversity Committee and changed the name of the Compensation Committee to the “HumanHuman Capital Management and Compensation Committee.” Committee

The Human Capital Management and Compensation Committee among other things,of the Board of Directors of the Company consists of Jerry W. Nix (Chairman), Patrick J. Gunning and John F. Wilson. The Human Capital Management and Compensation Committee is responsible for, overseeing the Company’s diversity efforts as noted below. among other things: | > | reviewing the Company’s executive compensation philosophy and strategy; |

| > | reviewing and approving the corporate goals and objectives relevant to the compensation of the Company’s CEO and executive officers; |

| > | evaluating the performance of the Company’s CEO and executive officers; |

| > | reviewing the compensation of the Company’s Non-Employee Directors for service on the Board and its committees and recommending to the Board changes to their compensation program as appropriate; |

| > | determining the stock ownership guidelines for the Company’s Non-Employee Directors, CEO, executive officers, and other key executives and monitoring compliance with such guidelines; |

| > | overseeing the development and management of the Company’s human capital management strategy and policies, including, but not limited to, those policies and strategies regarding diversity, equity and inclusion; and |

| > | reviewing, approving and administering incentive compensation and equity compensation plans for executive officers and directors. |

The previous functionBoard has determined that all members of the DiversityHuman Capital Management and Compensation Committee until December 2021 wasare independent as defined by the rules of the SEC and NYSE. In addition, each member of our Human Capital Management and Compensation Committee is also a Non-Employee Director, as defined pursuant to monitor compliance with applicable non-discrimination laws. EachRule 16b-3 of the Exchange Act. The Company is not required by law or by the NYSE rules to have a formal compensation committee charter since we are a controlled corporation as described below under the heading Director Independence and NYSE Requirements. However, we have established a written charter of the Human Capital Management and Compensation Committee to promote responsible corporate governance practices, and we currently intend to maintain the committee charter going forward. See section titled Compensation Discussion & Analysis—Compensation Setting Process for information regarding the Human Capital Management and Compensation Committee’s processes. Human Capital Management and Compensation Committee Interlocks and Insider Participation The Board has determined that each member of the DiversityHuman Capital Management and Compensation Committee is independent in 2021 was independent.accordance with the NYSE rules. The Human Capital Management and Compensation Committee consists of Messrs. Nix, Gunning, and Wilson. None of these individuals is a current or former officer or employee of the Company or any of its subsidiaries. Related party transactions and the independence of the non-employee members of the Company’s Board are discussed in more detail under the following sections, Director Independence and NYSE Requirements, and Certain Relationships and Related Party Transactions, of this Proxy Statement. No executive officer of the Company has served as a director or member of the compensation committee or other board committee of another entity that had an executive officer who served on the Company’s Board or Human Capital Management and Compensation Committee. Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors of the Company consists of Jerry W. Nix (Chairman), Patrick J. Gunning, John F. Wilson, Timothy C. Rollins and Amy R. Kreisler. The Nominating and Corporate Governance Committee is responsible for, among other things: | > | determining the appropriate qualifications required for the members of the Board; |

| > | recommending Board committee chairs and assignments; |

| > | recommending to our Board nominees for director and to consider any nominations properly made by a stockholder, to make recommendations to our Board of Directors regarding the agenda for our Annual Meetings of Stockholders, and appropriate action to be taken in response to any stockholder proposals; |

| > | conducting periodic reviews of the composition and size of the Board and its committees, as well as the frequency and procedures of Board meetings; |

| > | overseeing compliance with key corporate governance policies, including the Company’s Corporate Governance Guidelines and Independence Guidelines; |

| > | reviewing and approving related party transactions by a sub-committee of independent members: |

| > | reviewing and monitoring the Company’s ESG practices, policies, programs and public disclosures; and |

| > | reviewing and assessing the adequacy of the Company’s Code of Business Conduct and Ethics. |

The Company is not required by law or by the NYSE rules to have a nominating committee since we are a controlled corporation as described below under the heading “Director Independence and NYSE Requirements.” However, we have established a Nominating and Corporate Governance Committee and a written charter to promote responsible corporate governance practices. We currently intend to maintain the committee going forward, but as a controlled company, we rely upon the exemption from the requirement that we have a nominating committee comprised entirely of independent directors. Director Nominations Under Delaware law, there are no statutory criteria or qualifications for directors. No criteria or qualifications have been prescribed by the Board at this time. The Nominating and Corporate Governance Committee does not have a formal policy with regard to the consideration of director candidates. As such, there is no formal policy relative to diversity, although as noted below, it is one of many factors that the Nominating and Corporate Governance Committee has the discretion to factor into its decision making. This discretion would extend to how the Committee might define diversity in a particular instance – whether in terms of background, viewpoint, experience, education, race, gender, national origin or other considerations. The Committee acts under the guidance of the Corporate Governance Guidelines approved by the Board of Directors and posted on the Company’s website at www.rpc.net under the Governance section. The Board believes that it should preserve maximum flexibility in order to select directors with sound judgment and other desirable qualities. According to the Company’s Corporate Governance Guidelines, the Board of Directors is responsible for selecting nominees for election to the Board of Directors. The Board has delegated the screening process of director nominees for nomination to the Board and service on the committees of the Board to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for determining the appropriate skills and characteristics required of Board members in the context of the then current makeup of the Board. This determination takes into account all factors which the Committee considers appropriate, such as independence, experience, strength of character, mature judgment, technical skills, diversity, age and the extent to which the individual would fill a present need on the Board. The Bylaws provide that nominations for the election of directors may be made by any stockholder entitled to vote for the election of directors. Nominations must comply with an advance notice procedure which generally requires, with respect to nominations for directors for election at an annual meeting, that written notice be addressed to: The Corporate Secretary, RPC, Inc., 2801 Buford Highway NE, Suite 300, Atlanta, Georgia 30329, and received not less than 90 nor more than 130 days prior to the anniversary of the prior year’s annual meeting and set forth among other requirements specified in the Bylaws, the name, age, business address and, if known, residence address of the nominee proposed in the notice, the principal occupation or employment of the nominee for the past five years, the nominee’s qualifications, the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the person and any other information relating to the person that would be required to be disclosed in a proxy statement or other filings. Other requirements related to the notice are contained in the Bylaws and stockholders are advised to carefully review those requirements to ensure that nominations comply with the Bylaws; stockholders who intend to solicit proxies in support of director nominees other than the Board’s nominees must also comply with SEC Rule 14a-19(b). The Committee will consider nominations from stockholders that satisfy these requirements. All of the nominees for directors being voted upon at the Annual Meeting to be held on April 23, 2024 are currently serving on the Board of Directors. Board Leadership STRUCTURE The Board believes the current leadership structure consisting of a separate Executive Chairman of the Board, Chief Executive Officer and Lead Independent Director represents the appropriate structure for the Company at this time. Richard A. Hubbell is the Executive Chairman of the Board and sets the agendas for Board meetings in consultation with the CEO, Corporate Secretary, and other members of the Board, and presides over all Board meetings and the Annual Meeting of Stockholders. Ben M. Palmer is the President and Chief Executive Officer and sets the operational leadership and strategic direction of the Company. Jerry W. Nix is the Lead Independent Director and serves as the liaison between the Executive Chairman, CEO and the independent directors, sets the agenda for, and presides over, the executive sessions of the non-employee and independent directors, consults with the Executive Chairman and CEO regarding information sent to the Board in connection with Board meetings and is available, if requested by the stockholders, when appropriate, for consultation and direct communication. Risk Oversight Our Board of Directors provides oversight of the Company’s overall risk management practices. “Risk” is an extremely broad concept that extends to multiple functional areas and crosses multiple disciplines. As such, risk may be addressed from time to time by the full Board or by one or more of our Committees. Senior management is responsible for identifying and managing material risks that we face while insurable risks and litigation risks are handled primarily by the risk management department. Senior management provides the Board with a summary of insurance coverage annually and updates as deemed necessary. Liquidity risk, credit risk and risks associated with our credit facilities and cash management are handled primarily by our finance department which regularly provides a financial report to both the Audit Committee and to the full Board. Operational, business, regulatory and political risks are handled primarily by senior executive management which regularly provides various operational reports to, among others, the full Board, the Executive Committee and the Audit Committee. Cybersecurity Risk Oversight The Board has delegated its responsibility for oversight of the Company’s cybersecurity and information security framework and risk management to the Audit Committee. The Audit Committee receives information and updates at least quarterly and actively engages with senior leaders with respect to the effectiveness of the Company’s cybersecurity and information security framework, data privacy, and risk management. In addition, the Audit Committee receives reports summarizing threat detection and mitigation plans, audits of internal controls, training and certification, and other cyber priorities and initiatives, as well as timely updates from senior leaders on material incidents relating to information systems security, including cybersecurity incidents. The Audit Committee includes members with experience in risk management including cybersecurity. RPC’s cybersecurity program is overseen by the Chief Information Officer (CIO) as well as several key members of RPCs Enterprise Technology team including the Principal Security Architect. These key leaders collectively have over 50 years of experience in network security, cybersecurity and enterprise risk management. The Chief Executive Officer and CIO receive regular updates on cybersecurity matters, results of mitigation efforts related to existing risks and cybersecurity incident response and remediation. Director Independence and NYSE Requirements Controlled Company Exemption The Company has elected to be treated as a “controlled company” as defined by NYSE Section 303A.00. This Section provides that a controlled company need not comply with the requirements of Sections 303A.01, 303A.04 and 303A.05 of the NYSE Listed Company Manual. Section 303A.01 requires that listed companies have a majority of independent directors. As a controlled company, this Section does not apply to the Company. Sections 303A.04 and 303A.05 require that listed companies have a nominating and corporate governance committee and a compensation committee, in each case composed entirely of independent directors, and that each of these committees must have a charter that addresses both the committee’s purpose and responsibilities and the need for an annual performance evaluation by the committee. While the Company has a Nominating and Corporate Governance committee and a Human Capital Management and Compensation committee, and each of these committees has a written charter that is available on the Company’s website, it is not required to and does not comply with all of the provisions of Sections 303A.04 and 303A.05. The Company is a “controlled company” because a group that includes Gary W. Rollins, Pamela R. Rollins, Timothy C. Rollins, and Amy R. Kreisler, each of whom is a director of the Company, and certain companies under their control, controls in excess of 50% of the Company’s voting power. This means that they have the ability to determine the outcome of the election of directors at the Company’s annual meetings and to determine the outcome of many significant corporate transactions, many of which only require the approval of a majority of the Company’s voting power. Such a concentration of voting power could also have the effect of delaying or preventing a third party from acquiring the Company at a premium. The Company’s Audit Committee is composed of four “independent” directors as defined by the Company’s Corporate Governance Guidelines, the NYSE rules, the Exchange Act, SEC regulations thereunder, and the Company’s Audit Committee Charter. All of the members of the Human Capital Management and Compensation Committee, and a majority of the members of Nominating and Corporate Governance Committee are also “independent” directors. The current independent directors of the Company are Jerry W. Nix, Susan R. Bell Patrick J. Gunning, and John F. Wilson. Independence Guidelines Under NYSE listing standards, to be considered independent, a director must be determined to have no material relationship with the Company other than as a director. The NYSE standards set forth a nonexclusive list of relationships which are conclusively deemed material. The Company’s Independence Guidelines are posted on the Company’s website at www.rpc.net under the Governance section and include categorical standards for determining independence in specific situations. Audit Committee Charter Under the Company’s Audit Committee Charter, in accordance with NYSE listing requirements and the Securities Exchange Act of 1934, all members of the Audit Committee must be independent of management and the Company. A member of the Audit Committee is considered independent as long as he or she (i) does not accept any consulting, advisory, or compensatory fee from the Company, other than as a director or committee member; (ii) is not an affiliated person of the Company or its subsidiaries; and (iii) otherwise meets the independence requirements of the NYSE and the Company’s Corporate Governance Guidelines. Nonmaterial Relationships After reviewing all of the relationships between the independent directors and the Company, the Board of Directors determined that none of independent directors had any relationships that impaired their independence and discussed the following: | ● | Jerry W. Nix, Susan R. Bell, Patrick J. Gunning, and John F. Wilson served on the Boards of Rollins, Inc. and Marine Products Corporation. Gary W. Rollins, Pamela R. Rollins, Tim Rollins and Amy R. Kreisler are directors of Marine Products Corporation and are part of a control group that has voting control over the Company. Gary W. Rollins and Pamela R. Rollins are directors of Rollins, Inc, and along with Tim Rollins and Amy R. Kreisler, are part of a significant shareholder group that owns a controlling interest in the Company. That signficant shareholder group had a controlling interest in Rollins, Inc. prior to September 2023. Gary W. Rollins and John F. Wilson are also executive officers of Rollins, Inc. |

As required by the Independence Guidelines, the Board of Directors unanimously concluded that the above-listed relationships would not affect the independent judgment of the independent directors, based on their experience, character and independent means, and therefore do not preclude an independence determination. All of the members of the Audit Committee are also independent under the heightened standards required for Audit Committee members. The Company’s non-management directors meet at regularly scheduled executive sessions, and the independent directors separately meet at least once annually, without management, in accordance with the NYSE corporate governance listing standards, and Mr. Jerry W. Nix, as Lead Independent Director, presided over the executive sessions held during 2023. Corporate Governance Guidelines We have adopted Corporate Governance Guidelines to formalize and promote better understanding of our policies and procedures. At least annually, the Board reviews these guidelines. As required by the rules of the NYSE, our Corporate Governance Guidelines require that our non-management directors meet in regularly scheduled executive sessions each year without management, and such meetings are currently required to occur at least twice annually. At the Company’s website at www.rpc.net, under the Governance section, you may access a copy of the Company’s Corporate Governance Guidelines, Audit Committee Charter, Human Capital Management and Compensation Committee Charter, Nominating and Corporate Governance Committee Charter, Code of Business Conduct, Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transactions Policy, and Independence Guidelines. Code of Business Conduct The Company has adopted a Code of Business Conduct applicable to all directors, officers and employees generally, as well as a Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transactions Policy applicable to the principal executive officer, principal financial officer, and directors. Both codes are available on the Company’s website at www.rpc.net under the Governance section. Director Communications The Company also has a process for interested parties, including stockholders, to send communications to the Board of Directors, Lead Independent Director, any of the Board committees or the non-management or independent directors as a group. Such communications should be addressed as follows: Mr. Jerry W. Nix c/o Internal Audit Department RPC, Inc. 2801 Buford Highway NE, Suite 300 Atlanta, Georgia 30329 |

The above instructions for communications with the directors are also posted on our website at www.rpc.net under the Governance section. All communications received from interested parties are forwarded to the Board of Directors. Any communication addressed solely to the Lead Director or the non-management or independent directors will be forwarded directly to the appropriate addressee(s). DIRECTOR COMPENSATION Overview of the Non-Employee Director Compensation Program Members of the Board who are not employees (Non-Employee Directors) receive compensation for their service. As RPC employees, Messrs. Hubbell and Palmer do not receive compensation for their service as Board members. The compensation program for our Non-Employee Directors is intended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders. All Non-Employee Directors are also entitled to reimbursement of expenses for all services as a director, including reasonable travel expenses incurred in connection with required in-person attendance at board and committee meetings, committee participation or special assignments. The Human Capital Management and Compensation Committee annually reviews each element and the total of our Non-Employee Director Compensation Program and periodically makes recommendations for any changes to the Board. There were no changes made to the Non-Employee Director Compensation Program for 2024. 2023 Annual Non-Employee Director Compensation Program Cash and Equity Compensation Under the Director Compensation Program in effect in 2023, our Non-Employee Directors received an annual cash retainer and an annual equity grant in the form of fully vested Company common shares under the Company’s 2014 Equity Stock Incentive Plan (SIP); Committee Chairs and members received additional annual cash retainers. All cash retainers are payable in equal quarterly installments in arrears. For each Non-Employee Director who is elected or appointed for the first time, the first quarterly installment of the annual cash retainers will be paid for the first quarter that ends on or after the date of his or her initial election or appointment, prorated based on service during the quarter. In addition, equity retainers are not granted to the Non-Employee Director who is elected to the Board during the latter half of a year. The following table sets forth the 2023 Non-Employee Director Compensation Program: | | | | | | | | | | | Annual | | Annual | | Annual | | Committee | | | Chair | | Board Member | | Equity | | Member Annual | | | Retainer | | Retainer | | Retainer | | Cash Retainer | Board/Committee | | ($) | | ($) | | ($) | | ($) | Board of Directors | | — | | 75,000 | | 50,000 | | — | Lead Independent Director | | 10,000 | | — | | — | | — | Audit Committee | | 20,000 | | — | | — | | 6,000 |

Controlled Company Exemption The Company has elected to be treated as a “controlled company” as defined by NYSE Section 303A.00. This Section provides that a controlled company need not comply with the requirements of Sections 303A.01, 303A.04 and 303A.05 of the NYSE Listed Company Manual. Section 303A.01 requires that listed companies have a majority of independent directors. As a controlled company, this Section does not apply to the Company. Sections 303A.04 and 303A.05 require that listed companies have a nominating and corporate governance committee and a compensation committee, in each case composed entirely of independent directors, and that each of these committees must have a charter that addresses both the committee’s purpose and responsibilities and the need for an annual performance evaluation by the committee. While the Company has a Nominating and Corporate Governance committee and a Human Capital Management and Compensation Committee

The Human Capital Managementcommittee, and Compensation Committeeeach of these committees has a written charter that is available on the Company’s website, it is not required to and does not comply with all of the Boardprovisions of DirectorsSections 303A.04 and 303A.05. The Company is a “controlled company” because a group that includes Gary W. Rollins, Pamela R. Rollins, Timothy C. Rollins, and Amy R. Kreisler, each of whom is a director of the Company, consistsand certain companies under their control, controls in excess of Messrs. Jerry W. Nix (Chairman)50% of the Company’s voting power. This means that they have the ability to determine the outcome of the election of directors at the Company’s annual meetings and Patrick J. Gunning. to determine the outcome of many significant corporate transactions, many of which only require the approval of a majority of the Company’s voting power. Such a concentration of voting power could also have the effect of delaying or preventing a third party from acquiring the Company at a premium.

The Human Capital Management and CompensationCompany’s Audit Committee is responsible for, among other things:

| ● | reviewing the Company’s executive compensation philosophy and strategy; |

| ● | reviewing and approving the corporate goals and objectives relevant to the compensationcomposed of four “independent” directors as defined by the Company’s Corporate Governance Guidelines, the NYSE rules, the Exchange Act, SEC regulations thereunder, and the Company’s Audit Committee Charter. All of the Company’s CEO and executive officers; |

| ● | evaluating the performance of the Company’s CEO and executive officers; |

| ● | reviewing the compensation of the Company’s non-employee directors for service on the Board and its committees and recommending changes to the Company’s director compensation program as appropriate; |

| ● | determining the stock ownership guidelines for the Company’s CEO, executive officers, and other key executives and monitoring compliance with such guidelines; |

| ● | overseeing the development and management of the Company’s human capital management strategy and policies, including, but not limited to, those policies and strategies regarding diversity, equity and inclusion; and |

| ● | reviewing, approving and administering incentive compensation and equity compensation plans for executive officers and directors. |

As noted above, in December 2021, the Board dissolved the Diversity Committee and changed the name of the Compensation Committee to the Human Capital Management and Compensation Committee. The Board also approved a written charter of the Human Capital Management and Compensation Committee which outlines the Committee’s expanded responsibilities as outlined above. The Board has determined that all members of the Human Capital Management and Compensation Committee, and a majority of the members of Nominating and Corporate Governance Committee are also “independent” directors. The current independent directors of the Company are Jerry W. Nix, Susan R. Bell Patrick J. Gunning, and John F. Wilson.

Independence Guidelines Under NYSE listing standards, to be considered independent, a director must be determined to have no material relationship with the Company other than as a director. The NYSE standards set forth a nonexclusive list of relationships which are conclusively deemed material. The Company’s Independence Guidelines are posted on the Company’s website at www.rpc.net under the Governance section and include categorical standards for determining independence in specific situations. Audit Committee Charter Under the Company’s Audit Committee Charter, in accordance with NYSE listing requirements and the Securities Exchange Act of 1934, all members of the Audit Committee must be independent of management and the Company. A member of the Audit Committee is considered independent as definedlong as he or she (i) does not accept any consulting, advisory, or compensatory fee from the Company, other than as a director or committee member; (ii) is not an affiliated person of the Company or its subsidiaries; and (iii) otherwise meets the independence requirements of the NYSE and the Company’s Corporate Governance Guidelines. Nonmaterial Relationships After reviewing all of the relationships between the independent directors and the Company, the Board of Directors determined that none of independent directors had any relationships that impaired their independence and discussed the following: | ● | Jerry W. Nix, Susan R. Bell, Patrick J. Gunning, and John F. Wilson served on the Boards of Rollins, Inc. and Marine Products Corporation. Gary W. Rollins, Pamela R. Rollins, Tim Rollins and Amy R. Kreisler are directors of Marine Products Corporation and are part of a control group that has voting control over the Company. Gary W. Rollins and Pamela R. Rollins are directors of Rollins, Inc, and along with Tim Rollins and Amy R. Kreisler, are part of a significant shareholder group that owns a controlling interest in the Company. That signficant shareholder group had a controlling interest in Rollins, Inc. prior to September 2023. Gary W. Rollins and John F. Wilson are also executive officers of Rollins, Inc. |

As required by the Independence Guidelines, the Board of Directors unanimously concluded that the above-listed relationships would not affect the independent judgment of the independent directors, based on their experience, character and independent means, and therefore do not preclude an independence determination. All of the members of the Audit Committee are also independent under the heightened standards required for Audit Committee members. The Company’s non-management directors meet at regularly scheduled executive sessions, and the independent directors separately meet at least once annually, without management, in accordance with the NYSE corporate governance listing standards, and Mr. Jerry W. Nix, as Lead Independent Director, presided over the executive sessions held during 2023. Corporate Governance Guidelines We have adopted Corporate Governance Guidelines to formalize and promote better understanding of our policies and procedures. At least annually, the Board reviews these guidelines. As required by the rules of the SECNYSE, our Corporate Governance Guidelines require that our non-management directors meet in regularly scheduled executive sessions each year without management, and NYSE. In addition, each membersuch meetings are currently required to occur at least twice annually. At the Company’s website at www.rpc.net, under the Governance section, you may access a copy of ourthe Company’s Corporate Governance Guidelines, Audit Committee Charter, Human Capital Management and Compensation Committee is also a non-employee director, as defined pursuant to Rule 16b-3Charter, Nominating and Corporate Governance Committee Charter, Code of the Exchange Act.Business Conduct, Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transactions Policy, and Independence Guidelines. Code of Business Conduct

The Company is not required by law or byhas adopted a Code of Business Conduct applicable to all directors, officers and employees generally, as well as a Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transactions Policy applicable to the NYSE rules to have a formal compensation committee charter since weprincipal executive officer, principal financial officer, and directors. Both codes are a controlled corporation as described below available on the Company’s website at www.rpc.net under the heading Governance section. Director Independence and NYSE Requirements. However, we have establishedCommunications The Company also has a written charterprocess for interested parties, including stockholders, to send communications to the Board of Directors, Lead Independent Director, any of the Human Capital Management and Compensation CommitteeBoard committees or the non-management or independent directors as a group. Such communications should be addressed as follows: Mr. Jerry W. Nix c/o Internal Audit Department RPC, Inc. 2801 Buford Highway NE, Suite 300 Atlanta, Georgia 30329 |

The above instructions for communications with the directors are also posted on our website at www.rpc.net under the Governance section. All communications received from interested parties are forwarded to promote responsible corporate governance practices, and we currently intendthe Board of Directors. Any communication addressed solely to maintain the committee going forward.Lead Director or the non-management or independent directors will be forwarded directly to the appropriate addressee(s).

Human Capital Management and Compensation Committee Interlocks and Insider ParticipationDIRECTOR COMPENSATION

The Board has determined that each memberOverview of the Human Capital ManagementNon-Employee Director Compensation Program

Members of the Board who are not employees (Non-Employee Directors) receive compensation for their service. As RPC employees, Messrs. Hubbell and Compensation CommitteePalmer do not receive compensation for their service as Board members. The compensation program for our Non-Employee Directors is independentintended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders. All Non-Employee Directors are also entitled to reimbursement of expenses for all services as a director, including reasonable travel expenses incurred in accordanceconnection with the NYSE rules. required in-person attendance at board and committee meetings, committee participation or special assignments. The Human Capital Management and Compensation Committee consistsannually reviews each element and the total of Messrs. Nixour Non-Employee Director Compensation Program and Gunning. Neitherperiodically makes recommendations for any changes to the Board. There were no changes made to the Non-Employee Director Compensation Program for 2024. 2023 Annual Non-Employee Director Compensation Program Cash and Equity Compensation Under the Director Compensation Program in effect in 2023, our Non-Employee Directors received an annual cash retainer and an annual equity grant in the form of these individualsfully vested Company common shares under the Company’s 2014 Equity Stock Incentive Plan (SIP); Committee Chairs and members received additional annual cash retainers. All cash retainers are payable in equal quarterly installments in arrears. For each Non-Employee Director who is a currentelected or former officer or employeeappointed for the first time, the first quarterly installment of the Companyannual cash retainers will be paid for the first quarter that ends on or anyafter the date of its subsidiaries. Related party transactions andhis or her initial election or appointment, prorated based on service during the independence of the non-employee members of the Company’s Boardquarter. In addition, equity retainers are discussed in more detail under the following sections, Director Independence and NYSE Requirements, starting on page 7 and Certain Relationships and Related Party Transactions, startingon page 33 of this Proxy Statement. No executive officer of the Company has served as a director or member of the compensation committee or other board committee of another entity that had an executive officer who served on the Company’s Board or Human Capital Management and Compensation Committee. Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors of the Company consists of Messrs. Jerry W. Nix (Chairman) and Patrick J. Gunning. The Nominating and Corporate Governance Committee is responsible for, among other things:

| ● | determining the appropriate qualifications required for the members of the Board; |

| ● | recommending Board committee chairs and assignments; |

| ● | recommending to our Board nominees for director and to consider any nominations properly made by a stockholder, to make recommendations to our Board of Directors regarding the agenda for our Annual Meetings of Stockholders, and appropriate action to be taken in response to any stockholder proposals; |

| ● | conducting periodic reviews of the composition and size of the Board and its committees, as well as the frequency and procedures of Board meetings; |

| ● | overseeing compliance with key corporate governance policies, including the company’s corporate governance guidelines and independence guidelines; |

| ● | reviewing and approving related party transactions; |

| ● | reviewing and monitoring the Company’s ESG practices, policies, programs and public disclosures; and |

| ● | reviewing and assessing the adequacy of the Company’s Code of Business Conduct and Ethics. |

The Company is not required by law or by the NYSE rules to have a nominating committee since we are a controlled corporation as described below under the heading “Director Independence and NYSE Requirements.” However, we have established a Nominating and Corporate Governance Committee and a written charter to promote responsible corporate governance practices, and we currently intend to maintain the committee going forward.

Director Nominations

Under Delaware law, there are no statutory criteria or qualifications for directors. No criteria or qualifications have been prescribed by the Board at this time. The Nominating and Corporate Governance Committee does not have a formal policy with regardgranted to the consideration of director candidates. As such, thereNon-Employee Director who is no formal policy relative to diversity, although as noted below, it is one of many factors that the Nominating and Corporate Governance Committee has the discretion to factor into its decision making. This discretion would extend to how the Committee might define diversity in a particular instance — whether in terms of background, viewpoint, experience, education, race, gender, national origin or other considerations. The Committee acts under the guidance of the Corporate Governance Guidelines approved by the Board of Directors and posted on the Company’s website at www.rpc.net under the Governance section. The Board believes that it should preserve maximum flexibility in order to select directors with sound judgment and other desirable qualities. According to the Company’s Corporate Governance Guidelines, the Board of Directors will be responsible for selecting nominees for electionelected to the Board during the latter half of Directors.a year. The Board delegatesfollowing table sets forth the screening process to the Nominating and Corporate Governance Committee. This Committee is responsible for determining the appropriate skills and characteristics required of Board members in the context of the then current makeup of the Board. This determination takes into account all factors which the Committee considers appropriate, such as independence, experience, strength of character, mature judgment, technical skills,

diversity, age and the extent to which the individual would fill a present need on the Board. The Bylaws provide that nominations for the election of directors may be made by any stockholder entitled to vote for the election of directors. Nominations must comply with an advance notice procedure which generally requires, with respect to nominations for directors for election at an annual meeting, that written notice be addressed to: The Corporate Secretary, RPC, Inc., 2801 Buford Highway NE, Suite 300, Atlanta, Georgia 30329, and received not less than 90 nor more than 130 days prior to the anniversary of the prior year’s annual meeting and set forth among other requirements specified in the Bylaws, the name, age, business address and, if known, residence address of the nominee proposed in the notice, the principal occupation or employment of the nominee for the past five years, the nominee’s qualifications, the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the person and any other information relating to the person that would be required to be disclosed in a proxy statement or other filings. Other requirements related to the notice are contained in the Bylaws and stockholders are advised to carefully review those requirements to ensure that nominations comply with the Bylaws. The Committee will consider nominations from stockholders that satisfy these requirements.

The Committee is responsible for screening the nominees that are selected by the Board of Directors for nomination to the Board and for service on committees of the Board. All of the nominees for directors being voted upon at the Annual Meeting to be held on April 26, 2022 are currently serving on the Board of Directors.

Board Leadership

The Company has had separate persons serving as its Chairman of the Board and Chief Executive Officer since 2005. Mr. Gary W. Rollins is the Non-Executive Chairman and chairs our Board meetings. Mr. Richard A. Hubbell is our President and Chief Executive Officer. We believe that this represents the appropriate structure for us at this time; the Chairman of the Board provides general oversight and strategic planning for the Company, while the President and Chief Executive Officer focuses on optimizing operational efficiencies.

Risk Oversight by Board of Directors

Our Board of Directors’ oversight of risk has not been delegated to any Board Committee. “Risk” is an extremely broad concept that extends to multiple functional areas and crosses multiple disciplines. As such, risk may be addressed from time to time by the full Board or by one or more of our Committees. Senior management is responsible for identifying and managing material risks that we face while insurable risks and litigation risks are handled primarily by the risk management department. Senior management provides the Board with a summary of insurance coverage annually and updates as deemed necessary. Liquidity risk, credit risk and risks associated with our credit facilities and cash management are handled primarily by our finance department which regularly provides a financial report to both the Audit Committee and to the full Board. Operational, business, regulatory and political risks are handled primarily by senior executive management which regularly provides various operational reports to, among others, the full Board, the Executive Committee and the Audit Committee.

Cybersecurity Risk Oversight

Cybersecurity has become a particularly acute area of risk for companies of all sizes and in all industries, including our company. While management is primarily responsible for our cybersecurity program and managing our cybersecurity risks, including our procedures and day-to-day operations, our Audit Committee oversees our risk management program which includes oversight of cybersecurity risks. The Audit Committee reviews our cybersecurity risks and incidents and any other risks and incidents relevant to our information technology systems controls and security, and determines if any such risks and incidents should be disclosed in our periodic filings with the SEC.

In performing its oversight responsibilities, our Audit Committee receives periodic reports and reviews our information technology and cybersecurity risk profile. We use a variety of security products and vendors to protect our information technology infrastructure and data. Our programs continue to adapt and mature as threats continue to evolve. We maintain data encryption, monitoring, loss prevention, data storage, identity/authentication controls, including two-factor authentication tools, and anti-malware and anti-virus solutions. We also perform penetration tests and cyber simulations to

practice our incident response procedures. Our cybersecurity plans are reviewed on an annual basis, and we prioritize new and updated programs as needed to respond to the cybersecurity risks we may face. We train employees on cybersecurity risks, conduct annual tabletop exercises and generate internal phishing campaigns to assess the effectiveness of the training. We also regularly review our privacy policies to ensure compliance with all applicable data privacy regulations.

2023 Non-Employee Director Independence and NYSE RequirementsCompensation Program: | | | | | | | | | | | Annual | | Annual | | Annual | | Committee | | | Chair | | Board Member | | Equity | | Member Annual | | | Retainer | | Retainer | | Retainer | | Cash Retainer | Board/Committee | | ($) | | ($) | | ($) | | ($) | Board of Directors | | — | | 75,000 | | 50,000 | | — | Lead Independent Director | | 10,000 | | — | | — | | — | Audit Committee | | 20,000 | | — | | — | | 6,000 | Controlled Company Exemption

The Company has elected to be treated as a “controlled company” as defined by NYSE Section 303A.00. This Section provides that a controlled company need not comply with the requirements of Sections 303A.01, 303A.04 and 303A.05 of the NYSE Listed Company Manual. Section 303A.01 requires that listed companies have a majority of independent directors. As a controlled company, this Section does not apply to the Company. Sections 303A.04 and 303A.05 require that listed companies have a nominating and corporate governance committee and a compensation committee, in each case composed entirely of independent directors, and that each of these committees must have a charter that addresses both the committee’s purpose and responsibilities and the need for an annual performance evaluation by the committee. While the Company has a nominatingNominating and corporate governanceCorporate Governance committee and a compensationHuman Capital Management and Compensation committee, and each of these committees has a written charter that is available on the Company’s website, it is not required to and does not comply with all of the provisions of Sections 303A.04 and 303A.05. The Company is a “controlled company” because a group that includes the Company’s Non-Executive Chairman, Mr. Gary W. Rollins, Pamela R. Rollins, Timothy C. Rollins, and Amy R. Kreisler, each of whom is a director of the Company, and certain companies under histheir control, possessescontrols in excess of fifty percent50% of the Company’s voting power. This means that they have the ability to determine the outcome of the election of directors at the Company’s annual meetings and to determine the outcome of many significant corporate transactions, many of which only require the approval of a majority of the Company’s voting power. Such a concentration of voting power could also have the effect of delaying or preventing a third party from acquiring the Company at a premium. The Company’s Audit Committee is composed of threefour “independent” directors as defined by the Company’s Corporate Governance Guidelines, the NYSE rules, the Exchange Act, SEC regulations thereunder, and the Company’s Audit Committee Charter. All of the members of both the Human Capital Management and Compensation Committee, and a majority of the members of Nominating and Corporate Governance CommitteesCommittee are also “independent” directors. The current independent directors of the Company are Messrs. Jerry W. Nix, andSusan R. Bell Patrick J. Gunning, and Ms. Susan R. Bell. Mr. Harry J. Cynkus was an independent director during 2021.John F. Wilson. Independence Guidelines Under NYSE listing standards, to be considered independent, a director must be determined to have no material relationship with the Company other than as a director. The NYSE standards set forth a nonexclusive list of relationships which are conclusively deemed material. The Company’s Independence Guidelines are posted on the Company’s website at www.rpc.netunder the Governance section and include categorical standards for determining independence in specific situations. Audit Committee Charter Under the Company’s Audit Committee Charter, in accordance with NYSE listing requirements and the Securities Exchange Act of 1934, all members of the Audit Committee must be independent of management and the Company. A member of the Audit Committee is considered independent as long as he or she (i) does not accept any consulting, advisory, or compensatory fee from the Company, other than as a director or committee member; (ii) is not an affiliated person of the Company or its subsidiaries; and (iii) otherwise meets the independence requirements of the NYSE and the Company’s Corporate Governance Guidelines.

Nonmaterial Relationships After reviewing all of the relationships between the independent directors and the Company, the Board of Directors determined that none of independent directors had any relationships not included within the categorical standards set forth in the Independence Guidelinesthat impaired their independence and discussed above except as follows:the following: | ● | 1. | Mr. Cynkus was employed by Rollins, Inc. from 1998 to 2015 and held several positions during that time including Senior Vice President, Chief Financial Officer and Treasurer. |

| 2. | Messrs.Jerry W. Nix, Susan R. Bell, Patrick J. Gunning, and Ms. Bell also serveJohn F. Wilson served on the Boards of Rollins, Inc. and Marine Products Corporation, of which Mr.Corporation. Gary W. Rollins, Pamela R. Rollins, Tim Rollins and Ms.Amy R. Kreisler are directors of Marine Products Corporation and are part of a control group that has voting control over the Company. Gary W. Rollins and Pamela R. Rollins are directors of Rollins, Inc, and have voting control over which is held byalong with Tim Rollins and Amy R. Kreisler, are part of a controlsignificant shareholder group of which Mr. Gary W,that owns a controlling interest in the Company. That signficant shareholder group had a controlling interest in Rollins, is a part. Mr.Inc. prior to September 2023. Gary W. Rollins isand John F. Wilson are also an executive officerofficers of Rollins, Inc. Mr. Cynkus was also a director of Rollins, Inc. and Marine Products Corporation during 2021. |

As required by the Independence Guidelines, the Board of Directors unanimously concluded that the above-listed relationships would not affect the independent judgment of the independent directors, based on their experience, character and independent means, and therefore do not preclude an independence determination. All of the members of the Audit Committee are also independent under the heightened standards required for Audit Committee members. The Company’s non-management directors meet at regularly scheduled executive sessions, and the independent directors separately meet at least once annually, without management. Inmanagement, in accordance with the NYSE corporate governance listing standards, and Mr. Jerry W. Nix, was electedas Lead Independent Director, in 2021 and presided over the executive sessions held during 2021.2023. Corporate Governance Guidelines We have adopted Corporate Governance Guidelines to formalize and promote better understanding of our policies and procedures. At least annually, the Board reviews these guidelines. As required by the rules of the NYSE, our Corporate Governance Guidelines require that our non-management directors meet in regularly scheduled executive sessions each year without management, and such meetings are currently required to occur at least twice annually. At the Company’s website at www.rpc.net, under the Governance section, you may access a copy of itsthe Company’s Corporate Governance Guidelines, Audit Committee Charter, Human Capital Management and Compensation Committee Charter, Nominating and Corporate Governance Committee Charter, Code of Business Conduct, Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transactions Policy, and Independence Guidelines. Code of Business Conduct The Company has adopted a Code of Business Conduct applicable to all directors, officers and employees generally, as well as a Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transactions Policy applicable to the principal executive officer, principal financial officer, and directors. Both codes are available on the Company’s website at www.rpc.netunder the Governance section. Director Communications The Company also has a process for interested parties, including stockholders, to send communications to the Board of Directors, Lead Independent Director, any of the Board committees or the non-management or independent directors as a group. Such communications should be addressed as follows:

| |

| Mr. Jerry W. Nix c/o Internal Audit Department RPC, Inc. 2801 Buford Highway NE, Suite 300 Atlanta, Georgia 30329 |

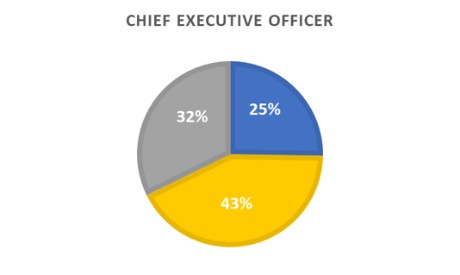

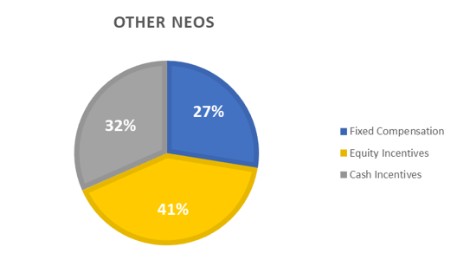

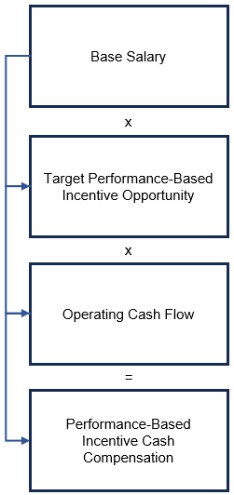

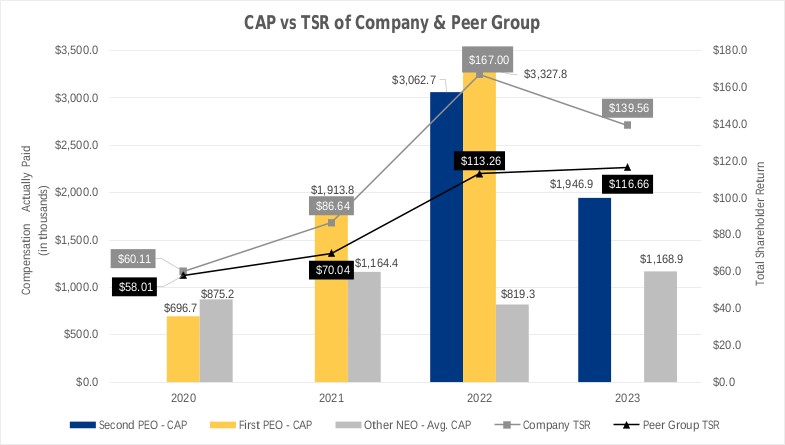

The above instructions for communications with the directors are also posted on our website at www.rpc.netunder the Governance section. All communications received from interested parties are forwarded to the Board of Directors. Any communication addressed solely to the Lead Director or the non-management or independent directors will be forwarded directly to the appropriate addressee(s). DIRECTOR COMPENSATION Overview of the Non-Employee Director Compensation Program Members of the Board who are not employees (Non-Employee Directors) receive compensation for their service. As an RPC employee, Mr.employees, Messrs. Hubbell does and Palmer do not receive compensation for histheir service as a Board member. members. The compensation program for our Non-Employee Directors is intended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our stockholders. All Non-Employee Directors are also entitled to reimbursement of expenses for all services as a director, including reasonable travel expenses incurred in connection with required in-person attendance at board and committee meetings, committee participation or special assignments. The Human Capital Management and Compensation Committee annually reviews each element and the total of our Non-Employee Director compensation program. In December 2021,Compensation Program and periodically makes recommendations for any changes to the Human Capital Management and Compensation Committee and the Board approvedBoard. There were no changes made to the Non-Employee Director compensation programCompensation Program for 2022.2024. 20212023 Annual Non-Employee Director Compensation Program